Preview of the Week Ahead

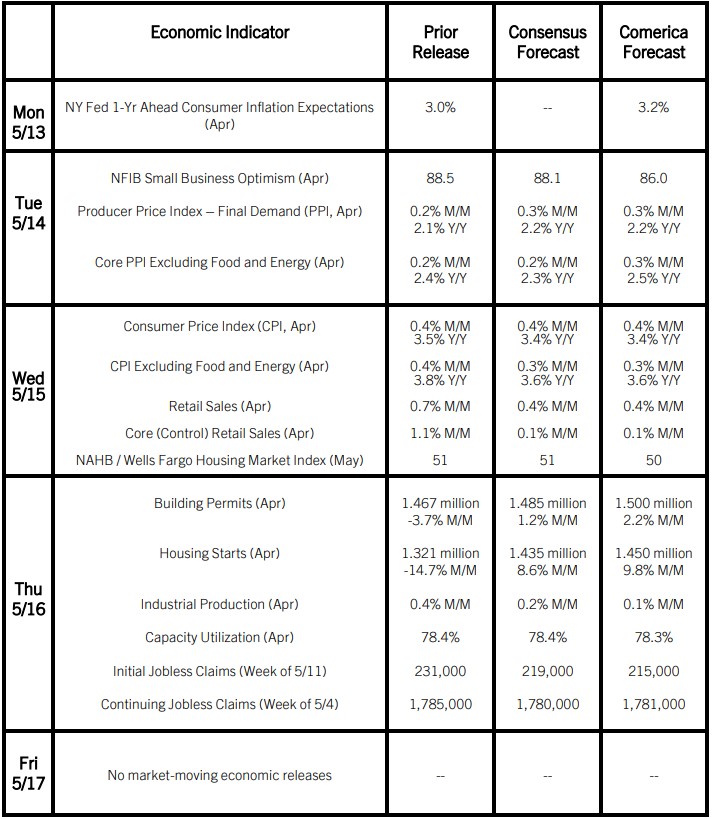

The CPI report will likely show total CPI continuing to move sideways between three and four percent, its range since mid-2023. Higher prices of gasoline likely added to inflation in April, as did higher chicken and beef prices, which were pushed upward by the bird flu outbreak. Core CPI likely edged down to its lowest year-over-year increase since mid-2021. PPI inflation likely ran cooler than CPI in April, since diesel prices fell in the month, unlike gasoline. More than outweighing cheaper diesel was the increase of metal commodity prices, as well as those more expensive unprocessed meats. Core PPI inflation likely picked up in monthly terms as suggested by the ISM Services PMI release earlier in the month.

Building permits and housing starts likely rebounded in April following big drops in March. These indicators are volatile month to month, but the underlying trend points to continued modest increases in single-family homebuilding, offsetting a downtrend in multifamily construction.

Industrial production likely increased modestly after a decline in March. Retail sales likely grew at a more moderate pace than March’s big increase, and core retail sales were likely little changed after higher tax bills for interest and capital gains income received in 2023 caught some Americans by surprise this year. These releases will likely reinforce expectations for slower real GDP growth in the rest of 2024 after robust growth in the second half of 2023.

The Week in Review

On the back of very strong tax receipts and a modest decline in expenditures, the federal government’s budgetary balance swung to a $210 billion surplus in April from a $237 billion deficit in March. Federal government receipts soared on a monthly basis, up 133.7%, and also on an annual basis, up 21.6%. Individual income tax and corporate income tax collections rose sharply by 8.1% and 25.1%, respectively, in the current fiscal year-to-date from the same period last year. While federal government expenditures were down modestly in April, they still were up 22.6% from a year ago.

Consumer sentiment unexpectedly tumbled to 67.4 in May from 77.2 in April. Consumers were more downbeat in their assessments of present conditions and the outlook, citing inflation, unemployment fears, and high interest rates. Reflecting concerns about higher prices, one year-ahead inflation expectations rose by 0.3 percentage points to 3.5%. Longer-term inflation expectations, which the Federal Reserve closely monitors in setting monetary policy, inched higher to 3.1% and were notably higher than the 2.5% average recorded between 2015 and 2020.

Consumer credit rose by $6.3 billion in March, in line with Comerica’s forecast, but well below the consensus estimate of $15.0 billion. Revolving credit, mostly credit card debt, rose by a mere $150 million, while nonrevolving credit, mostly auto and student loans, rose by $6.1 billion.

For a PDF version of this publication, click here: Comerica Economic Weekly, May 13, 2024(PDF, 174 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.