Florida’s Economic Boom Continues

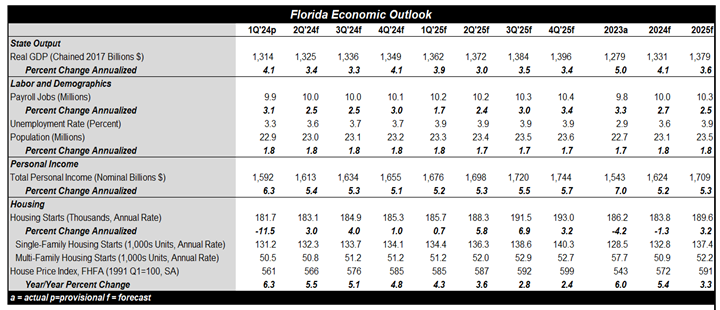

The Floridian economy is expected to once again grow robustly in 2024, expanding at roughly twice the pace of the national economy. The Sunshine State’s employment growth has outpaced the rest of the nation’s consistently in the past four years, but is expected to moderate in 2024. Nonetheless, job opportunities in the Sunshine State are expected to stay more plentiful than the rest of the nation. These job opportunities, along with the long-standing draws of low taxes, mild winters, and housing that’s more affordable than the Northeast, are expected to contribute to another solid year of population gains.

Spillovers from weaker national and global economies are expected to weigh on the critical tourism sector, contributing to a modest rise in the unemployment rate in 2024. Another step down for homebuilding is also likely to contribute to higher unemployment in the state. Nonetheless, Florida’s unemployment rate is expected to hold below the national unemployment rate. Total personal income is forecast to grow around 5%, solidly outpacing inflation.

Housing construction and sales are expected to remain soft as high house prices and interest rates strain affordability. Single-family construction is projected to increase, adding about 130,000 units to Florida’s housing supply. But a sharp uptick in rental vacancy rates over the past two years is weighing on multifamily construction, resulting in less multifamily construction this year. Reflecting higher supply, lower employment, and income gains, house price increases are likely to moderate further from the blistering pace of increases recorded in the last few years. High insurance costs and the exit of some insurers from certain markets in the state present downside risks to house prices.

For a PDF version of this publication, click here: 2024 Florida Mid-Year State Economic Outlook(PDF, 126 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.