Preview of the Week Ahead

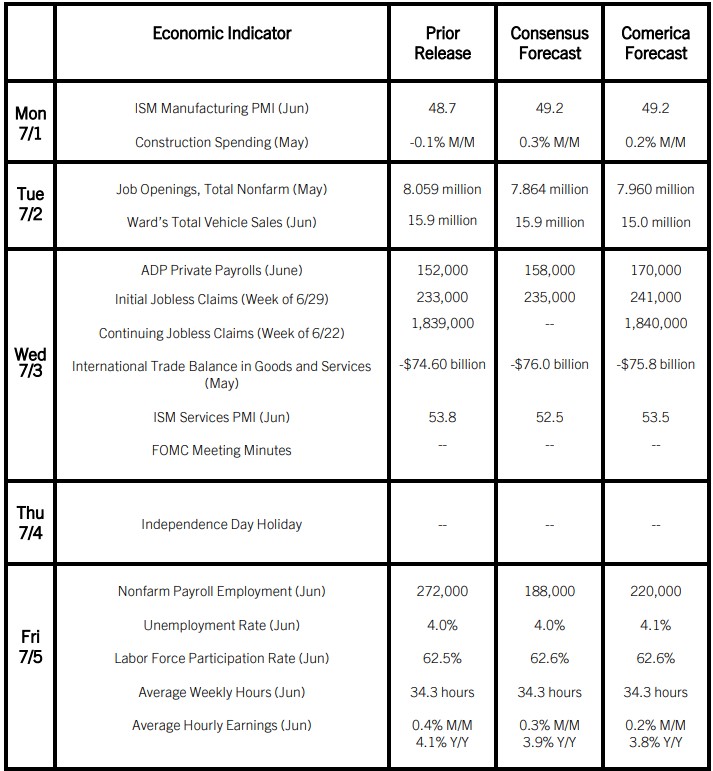

The June jobs report’s release Friday will likely show the unemployment rate rising to the highest since late 2021, despite a decent monthly gain in payroll employment. The timeliest data on job market conditions, the weekly jobless claims report, show initial and continued claims trending upward over the last few weeks. The latest report covering mid-June shows smoothed initial claims at the highest since last September, and smoothed continued claims at the highest since December 2021. The four-week average of claims is commonly used to smooth out week-to-week noise and show the trend.

The discrepancy we expect to see in the June data, between solid job gains and rising unemployment, reflects more re-entrants to the workforce, and slower job-finding among newly laid-off workers. The May Job Openings and Labor Turnover Survey, released shortly before the June jobs report, is expected to show another step down in job openings and a cool rate of hiring across nonfarm industries.

New vehicle sales likely fell sharply in June due to the impact of the CDK Global hack on auto dealers.

The Week in Review

Economic growth in the first quarter of 2024 was revised to 1.4% annualized in the third estimate from 1.3% in the second estimate. Real GDP rose 2.9% on the year. Consumer spending, however, was revised lower to a moderate 1.5% annualized rate and was driven solely by increased services spending. Consumer spending on goods fell sharply. Residential investment was revised up again to a 16.0% annualized surge. Business investment rose a solid 4.4%, with spending on computer equipment and intellectual property particularly strong. Government spending growth moderated to 1.8% following six quarters of strong increases. Net exports subtracted from real GDP as imports grew faster than exports. Inventory destocking also subtracted from growth.

The GDP Price Index was revised up a tenth of a percent to an annualized rate of 3.1% last quarter. The Personal Consumption Expenditures (PCE) Price Index—the Federal Reserve’s preferred inflation barometer—was also revised higher by 0.1% to 3.4%.

Household incomes, savings, and spending bounced back in May. Personal incomes rose by 0.5% on the back of a very strong increase in wages and salaries. After-tax, inflation-adjusted income was also up by a solid 0.5%. The savings rate rose to 3.9%, the highest in four months. Real consumer spending rose 0.3%, as expenditures on goods bounced back from a deep slump in April. Spending on services was up modestly. There was good news on the inflation front, with the PCE Price Index unchanged on the month and slowing to 2.6% from a year earlier, nearly the lowest in three years. The core PCE Price Index rose by modest 0.1% in May and was up 2.6% from a year ago, the lowest annual increase in three years.

Driven by transportation equipment orders, new durable goods orders rose by 0.1% in May, and core orders for nondefense capital goods excluding aircraft fell 0.6%. Core shipments fell 0.5%.

For a PDF version of this publication, click here: Comerica Economic Weekly, July 1, 2024(PDF, 175 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.